Public

Ball Corporation - Europe & Asia

Ball Corporation - South America

Ball Corporation Catalog

Ball Corporation Gallery

Ball Corporation Locations

Ball Corporation News

Ball Corporation- North America

If this is your company, CONTACT US to activate Packbase™ software to build your portal.

In 2013 the business delivered a good operational performance, and I am encouraged by the way we managed the challenge of a tough macroeconomic climate and higher aluminium premium and conversion costs.

The highlight of the year was the achievement of our target of 15% ROCE which we set in 2011. It was a great team effort. We also made good progress on our other strategic priorities. While maintaining strict capital discipline, we continued to invest for the future in markets where we are established and we strengthened our capabilities in emerging markets to support the sustainable growth of the business. We delivered another year of operational efficiency savings consistent with our target.

We increased our focus on innovation in both products and processes, and now have a much stronger innovation capability. And at the start of 2014, in line with our strategy to create a company that maximises return on capital employed, we announced that we had signed an agreement to divest the majority of the Healthcare packaging business and intend to return £450m of the proceeds to shareholders. The fact that we could deliver all of this and keep our focus on our strategic priorities in such challenging times speaks volumes for the commitment and dedication of our people.

Financial summary of the year

In summary, our Group's trading performance was slightly below our initial expectations. Total sales (which includes Healthcare) were £4,391m and total underlying operating profit was £513m. Total underlying profit before tax was £434m while total underlying earnings per share was 40.6p.

In Beverage Cans volume growth was 1% driven by the recovery of market share in the US and some growth in Europe. This, combined with the benefits of foreign exchange translation from the stronger US dollar and euro, saw sales grow to £3,943m (2012 restated: £3,885m). Organic sales, which adjust for the impact of foreign currency translation, were down 1% primarily due to the pass through of lower aluminium costs which were around 10% lower than in 2012.

We did not achieve our target of growing operating profit ahead of sales. Reported underlying operating profit was £449m (2012 restated: £448m) while organic operating profit declined 1% as higher metal conversion and aluminium premium costs offset the volume growth and foreign currency translation benefits. Underlying profit before tax was £372m (2012 restated: £358m), due largely to lower interest costs. Underlying earnings per share rose 13% to 35.3p driven by growth in adjusted operating profit and a lower share count reflecting the share consolidation at the start of the year.

Addressing customer needs with operational excellence

I am encouraged by the strong platform we are building for the Company's future. The overwhelming majority of the value we create comes from the products we make, and manufacturing excellence lies at the heart of our strategy to achieve sustainable profit growth. Operational and efficiency improvements make an important contribution to our profit growth each year and we use lean enterprise and six sigma principles and best practice sharing to continually drive efficiency and innovation in our can making process. These are complemented by sustainability measures to reduce emissions, material usage and waste. This year we delivered some £20m of savings in line with our expectations. I am also hugely encouraged by the further recognition from the Shingo Institute in early 2014 for another two of our facilities (the Enzesfeld can plant in Austria and our regional head office in Rio de Janeiro) to add to the five already accredited in South America. The Rio office is the first corporate office anywhere in the world to receive a Shingo award.

Our customers look at every option in their search for profitable growth. We have to ensure that the beverage can remains central to their marketing efforts. Where once we were mostly a relatively ‘high volume: standard product’ industry, the demand is now for more flexibility and shorter runs, all the while retaining low costs. We will naturally continue our focus on technologies that lower cost. However, addressing the cost of flexibility and working on viable solutions to meet the need for lower capacity production units in smaller markets are both an important part of our innovation platform.

Innovation is a priority

Innovation is an area we have consistently highlighted as important to our future, and during 2013 we made good progress establishing the internal structures, governance and areas of activity to address this strategic priority. We took the decision to participate earlier in the technology value chain and are now allocating part of our innovation funds to earlier stage development to help academic ideas come to commercial fruition.

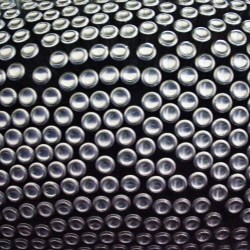

During the year, we invested to further our knowledge and understanding of the technology involved in aluminium smelting and rolling. In February 2014, we took an equity stake in Magnaparva Packaging, which draws on specialist expertise in the aerospace and defence sectors, to investigate disruptive technologies in metal forming to drive can lightweighting and reduce energy consumption.

Sustainability is a core platform

Sustainability continues to be an important platform of our strategy and a key element in reducing our costs and supporting our customers. It is about doing the right thing for our business, our people and the environment over the longer term. At the start of 2011 we set ourselves 20 ambitious sustainability targets for 2013 covering our products, operations and people. I am proud to say that we achieved 16 of those targets and made considerable progress on the other four.

Our progress has had a major positive impact on our business in terms of reduced material usage and on the environment. We are now embarking on a new phase. At the start of 2014, we will be undertaking a new materiality study to confirm the main sustainability issues relevant to us and our key stakeholders and from this we will develop further our sustainability framework and set challenging targets.

Our people deliver

Our drive for operational excellence extends to our people. In the face of a tough operating environment this year they have continued to do the Company proud. They play a vital role in the success of our business and we value their safety and wellbeing above everything else. So I am disappointed that, while our safety performance has improved in recent years and remains by industry standards high, we made little progress in 2013. We value the safety of our people and we have a concrete plan of action with a major Group safety programme, LIFE, to get us back on track to reducing the number of accidents and incidents.

On a more positive note it was very encouraging to see a high response rate to our most recent employment engagement survey. Our employee engagement index, which provides a picture of how satisfied and proud we are as a team, was 72% favourable. The corresponding figure in 2010 was 62%, so we have made good progress over the last three years with almost all items in the survey showing improvement.

Operational review of the year

Beverage Cans global volumes increased 1% on 2012. North America continued to perform strongly as it recovered market share but volumes in Western Europe and South America proved disappointing, especially in the first half of the year. Organic sales were down 1% as volume growth was offset by the pass through of lower aluminium prices.

Organic operating profit was down 1% at £449m mainly due to higher metal conversion and premium costs in both Europe and South America. The effect was compounded by a weaker mix of products as the share recovery in lower margin standard cans in North America was offset by the negative mix impact of weaker volumes in Europe (especially Russia).

Beverage Can Europe

The beverage can market in Europe comprises about 58bn cans, making it the third largest in the world, after North America and Asia. Rexam is the leading can maker with some 40% market share. The market has been growing at 3% pa since 2008 in a period of very low or non existent macroeconomic growth across the region. Growth has been driven largely by beer and carbonated soft drinks (CSD).

Despite a c 2% pa decline in beer consumption and little growth in the amount of CSD consumed in the last five years, the beverage can market has continued to grow in both categories as the pack mix shifts towards cans. Energy drinks have grown at a rate of 13% pa in the same period and, as the can is the container of choice in this beverage category, it has been a major driver of can growth.

In 2013, the weak macroeconomic backdrop in Europe made for challenging trading. In Western Europe, after a particularly cold winter and spring we had a strong second half, with volume in standard cans growing 6%. There was particularly strong growth in the Nordic countries and the UK, partly offset by some weakness in Spain. As a result standard cans were up 4% for the full year.

Specialty cans were 3% lower due to some share loss in the Benelux region but overall growth in energy drinks remained good.

In Russia, regulatory changes banning the sale of beer in kiosks resulted in an 8% decline in the market for beer cans and although this was partially offset by strong growth in CSD in cans, the overall can market declined by 2%. Even though absolute volumes for beer cans were down, we estimate that they captured a greater proportion of the pack mix. In 2013, the expected new competitor capacity came on stream and as a result we lost market share. We now have around 70% of the Russian beverage can market and expect our share to stabilise. We remain confident about the prospects and potential of this market.

Innovation in Europe has focused largely on our award winning FUSION™ bottle which our customers see as an important package for the future. During the year, we ramped up production at our plant in the Czech Republic and in 2014 we will continue to invest in line speed up as well as value adding contouring technologies. The specific technology we use will ultimately allow us to make the bottles with less material and, as the only manufacturer in Europe with access to this technology, we expect to gain competitive advantage. We also completed the conversion to new lighter weight ends.

We were vigorous in defending our market share in key markets in western Europe. In the first half we started production of standard cans at a new plant in Finland to serve the growing Nordic market. We opened a fourth line at our Ludesch plant in Austria to add an extra 0.7bn cans to the plant's capacity and also announced that we are to build a new can plant dedicated to energy drinks in Widnau, Switzerland. The latter will represent a total investment of some £115m over three years and will provide an extra 2.2bn cans when all three lines are completed. The first line is expected to come on stream in 2015.

Beverage Can North America

After peaking in 1994 at more than 100bn cans, the North American market has slowly reduced to its current c 94bn can market. Can consumption remains the highest in the world at more than 330 cans per capita per year. Rexam has more than 20% of the North American market. Following contract negotiations in 2010 we lost market share which we have now regained over the last three years. As a result we have a more diversified customer base and we do not expect significant changes in market share in the next few years, except for normal marginal movements.

In 2013, the North American beverage can market overall declined 3% led by a drop in sales of CSD. Our North American can business, however, traded well and our own volumes grew 7% as we regained market share. Standard cans were up 11% but, although there was some good growth in certain specialty can sizes, overall our specialty can volumes were down 3% against a very strong 2012 performance following the successful launch of Sleek™ cans.

We maintained a strong focus on operations and during the year all our plants in the US were Safe Quality Food (SQF) certified. Our cost reduction efforts continued apace with further improvement in efficiencies and material usage.

There was further progress in product innovation. We launched, for example, a new 25oz can to meet customer demand and to complement the already popular 24oz size, and we completed the creation of a new liner for the Rexam CapCan, a leading resealable package choice for many energy drink customers. This means that CapCan can now be used to package beer, dairy and spirits. The craft beer market, where the can is the packaging of choice, showed continued strong growth albeit from a small base. We have supported more than 40 new beer customers in recent years with a range of beverage can options from standard 12oz, through Sleek™ to 24oz to help launch and differentiate their products.

Outside the US, we see significant potential for further growth in Mexico and Central America with their increasing populations and improving GDP. We are participating in this growth through our own plant in Queretaro, Mexico, where we have seen specialty can growth of around 30% since 2010, and through a joint venture in Guatemala, which has doubled its volume since 2006. We continue to strengthen our relationships with regional customers and provide technical support to other local can manufacturers as we continue to explore additional opportunities.

Beverage Can South America

Brazil, Chile and Argentina are the three main markets we serve in South America. In total they consume c 23bn cans. Our largest market is Brazil where we are market leader with more than 50% market share. In Chile and Argentina we are the sole can makers.

In 2013, trading in South America was volatile. GDP growth in Brazil slowed to 2% and inflation was around 6%. In response to the weakening macroeconomic environment and declining disposable incomes, our customers prioritised specialty cans to differentiate their products and provide attractive price points with different can sizes.

The overall market in Brazil was up 4% driven by a 32% increase in specialty size volumes with standard cans volumes declining 5%.

Our volumes in South America were down 1%. The market weakness in standard cans drove most of the 8% decline in our standard can volumes. This was partly offset by a 22% increase in specialty cans. We were constrained in terms of specialty can capacity in the first half of the year but we converted our line in Belém to make specialty cans, and are in the process of converting another line in Brasilia. With our footprint adjusted to meet customer needs, we started to see a significant improvement in our performance and our volumes were up 5% in the seasonally strong final quarter. We continue to monitor the market closely and will convert more capacity if needed to ensure we can meet the market growth in 2014.

There was growth in Argentina while in Chile volumes improved significantly, driven by the additional demand for energy drinks in specialty cans and by customers’ strategies to promote single serve packages. We are adding a new specialty can line in Chile to satisfy the increasing demand for these types of cans.

Preparations in Brazil are well advanced for both the 2014 World Cup and the 2016 Olympics and the work on infrastructure and public transport in major cities is creating jobs and helping to stimulate the economy. Our customers are continuing to invest as planned, adding significant filling capacity in Brazil over the next three years.

Beverage Can Africa, Middle East & Asia

Historically our emerging market growth has been largely confined to Russia and Brazil where we are the leading player in both countries. We are now looking to develop new markets in Africa, Middle East & Asia (AMEA) which account for 75% of the world’s population and one third of total global beverage can volumes. They also represent significant proportions of our customers’ sales, and as they are now investing more in these markets, there is an opportunity not only for us to grow our business in line with theirs but also to seek alliances with local beverage producers.

We established our own AMEA organisation at the start of 2013 in Dubai: it is a suitable hub from which to manage the existing footprint and explore new opportunities. Operations consist of plants in Turkey, Egypt and India, the latter which we successfully converted from steel to aluminium. There is also a long standing joint venture in South Korea which mostly supplies the local market. We also have technical licences in Iran, China and Australia.

In February 2014, we announced the acquisition of a majority holding in United Arab Can (UAC), Saudi Arabia, with an annual capacity of 1.8bn cans in both standard and specialty sizes. Upon completion of the deal later in 2014, the plant will provide another bridgehead into growing markets and we plan to work together with our partners in UAC to expand in the region.

In 2013, volumes declined slightly in the AMEA region. Although volumes almost doubled in India, albeit from a low base, sales were disrupted by social unrest in Egypt and Turkey in the latter part of the year and we remain watchful of trading conditions in those regions.

Looking ahead as a focused beverage can maker

Rexam is now a focused beverage can maker. Our aim is to be the best in the industry and we have refined our strategy accordingly. Our intent, as ever, is to win, as we achieve a balance between growth and returns to create sustainable value for all our stakeholders.

We are committed to maintaining ROCE at around 15% as we grow the Company. It is a level of returns we deem appropriate given our asset base and geographic exposure. We have learnt valuable lessons over the last three years around managing costs, optimising cash and the disciplined employment of capital, and we will continue to keep these under close watch.

There are five main themes directing the strategy:

- We will invest to capture growth opportunities and to protect our core business, all the while maintaining the strict capital discipline of recent years and a focus on returns.

- We will strengthen our customer relationships, not simply by providing best in class quality and customer service at the right cost but also by working with them strategically and proactively. We will strengthen ties through commercial excellence and marketing capability and innovating to meet the challenge of profitable growth in a lower growth world.

- We will pursue continuous improvement in operational excellence with special emphasis on delivering first class products at cost at or below those of our competitors.

- We will shape our future by innovating and continuing to improve our sustainability performance to underpin our licence to operate and to support our customers as they face increasing consumer and legislative pressures.

- Finally, we will continue to build a winning organisation with the right structure and talent to support delivery of our strategy.

Next year we will be reporting against these five areas.

The work that we have done to restructure our Company means that we are in good shape operationally. In 2014, despite an uncertain macroeconomic environment and some continued cost volatility, we expect to make further progress on a constant currency basis. We remain committed to managing what we can control and focusing on cash, cost and return on capital employed as we pursue our strategy of balancing growth and returns.

The full report can be viewed on the Rexam website.