If this is your company, CONTACT US to activate Packbase™ software to build your portal.

Tekni-Plex has purchased automation equipment solutions manufacturer MMC Packaging Equipment Ltd. which will become part of Tekni-Plex’s Tri-Seal business.

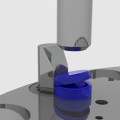

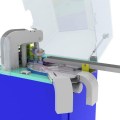

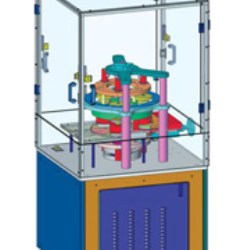

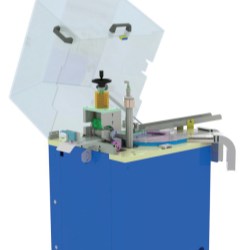

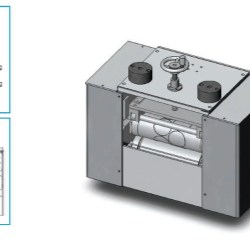

Headquartered in Laval, in the Montreal metropolitan region, Québec, Canada, MMC has a three-decade long reputation as a leading automation equipment manufacturer including cap lining, slitting/folding, assembling and closing systems. Additionally, the company develops and sells vision systems and custom automation equipment. MMC supports global customers in the food, beverage, personal and homecare, pharmaceutical, chemical and industrial sectors.

“We continue to drive our strategy by growing our business organically and through acquisitions. The acquisition of MMC allows us to bring an expanded array of solutions to the caps and closure packaging segment, as well as other markets. As experts in designing, assembling and supplying leading-edge, high-speed, post-molding automation systems, MMC’s global business perfectly complements Tri-Seal’s worldwide manufacturing footprint. With their innovative products and excellent manufacturing capabilities, as well as a very strong management team, we will be able to bring even more solutions to our customer base,” said Paul Young, president and chief executive officer, Tekni-Plex.

The acquisition adds 70 experienced employees to the 3,500-strong global Tekni-Plex team. MMC General Manager Christiane El-Tekly will continue to oversee the operation.

“We are excited about MMC’s future. Becoming part of the Tekni-Plex family will give MMC access to new growth opportunities and enable us to continue our commitment to high quality automation and superior customer service. Together, we will be able to accomplish great things for our customers and employees,” said Philippe McNally, president, MMC.

MMC is the fourteenth acquisition Tekni-Plex has made in the past five years, supporting its strategy to grow its business though transformative acquisitions and strategic add-ons.